Alpha Is Best Measured by Which of the Following Cfa

In general composite reliability based on CFA and Cronbachs alpha support the internal consistency of the scales. A measure of market sentiment.

Paid 11 A Brief Measure Of Diabetes Distress Validated In Adults With Type 1 Diabetes Diabetes Research And Clinical Practice

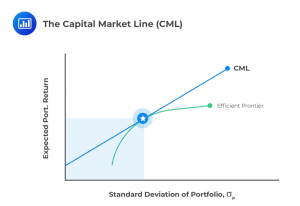

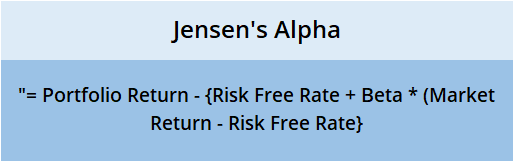

Jensens alpha is based on.

. Note that the factor score standard error2 is the error variance of the factor score. Minimum acceptable Cronbachs alpha H 0 065. He is the author of the Foreword Reviews Business Book of the Year Finalist The Intuitive Investor and the CEO of Active Investment Management AIM ConsultingVoss also sub-contracts for the well known firm Focus Consulting Group.

The buyer of an option contract. The beta of the fund versus that same index is 12 and the risk-free rate is 3. Receives the premium when the contract is initiated.

It is a nice turn of phrase for the negative correlation of managed futures at market extremes but whether it identifies. The funds alpha is calculated as. To get the reliability of the factor score you need to first calculate the latent constructs reliability from your CFA or rho.

The internal consistency measured by Cronbachs alpha was 0839 for the whole scale. Alpha is best measured by which of the following. Or Create Online Exam.

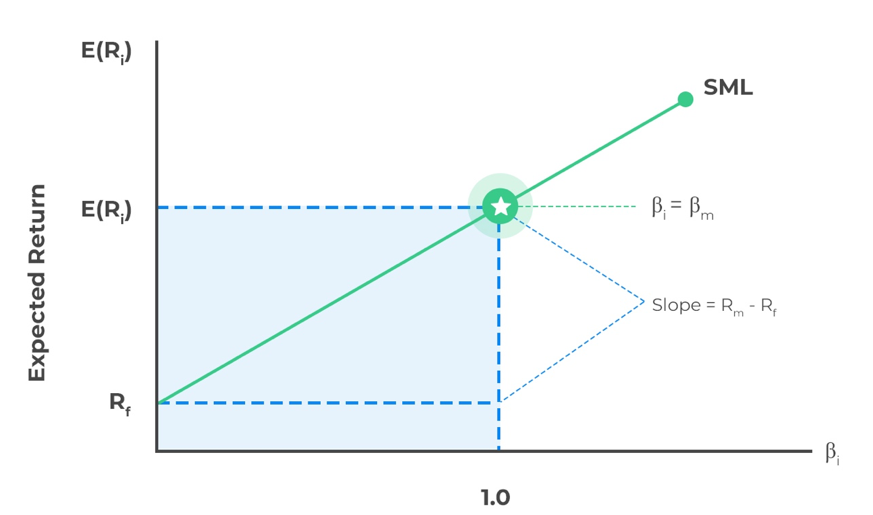

The EFA showed a bi-dimensional solution but the CFA indicated that the model with best indices of fit was the one-dimensional solution excluding the first item. Security market indices can be used to calculate alphas which are best described as. It is the abnormal return over the theoretical expected return.

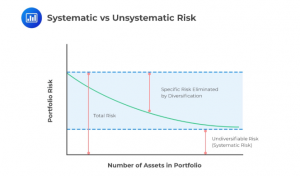

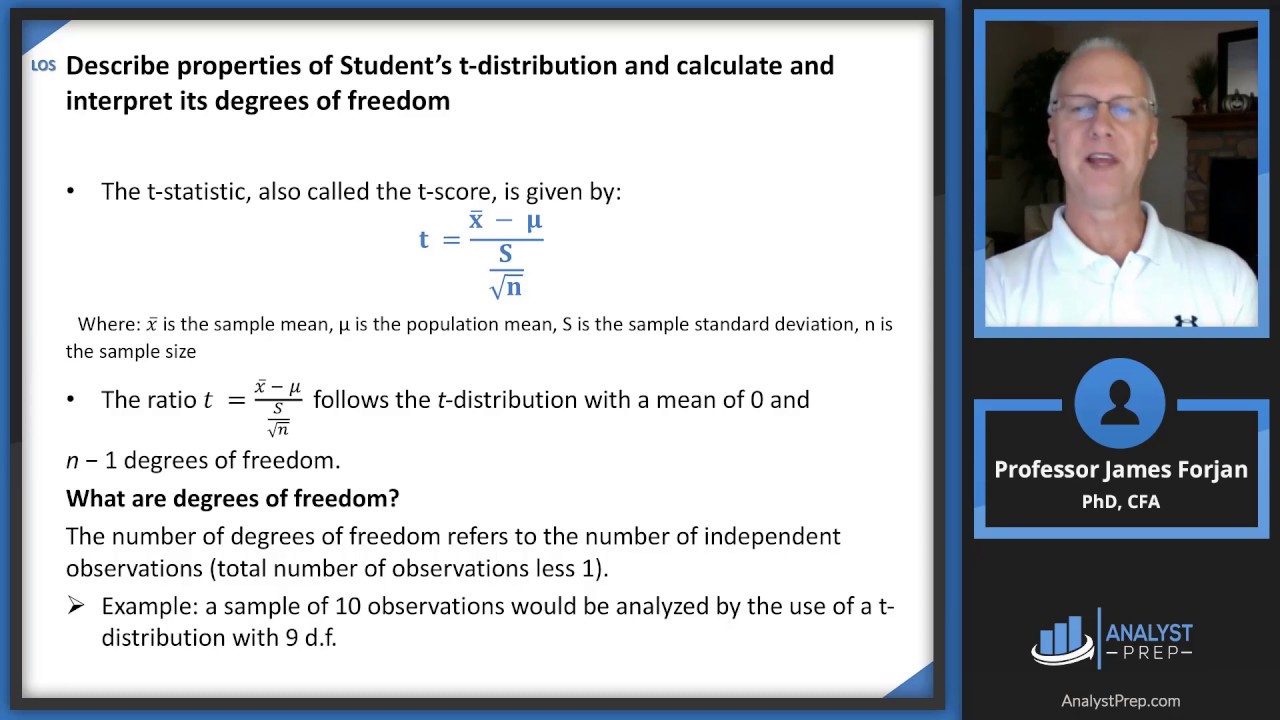

You will get 30 minutes to complete the test. The systematic risk of a security using the index as a proxy for the entire market. That is alpha is a function of total variance due to all systematic influences on the items ie both general and specific factors rather than a measure of how reliably the total score measures a single.

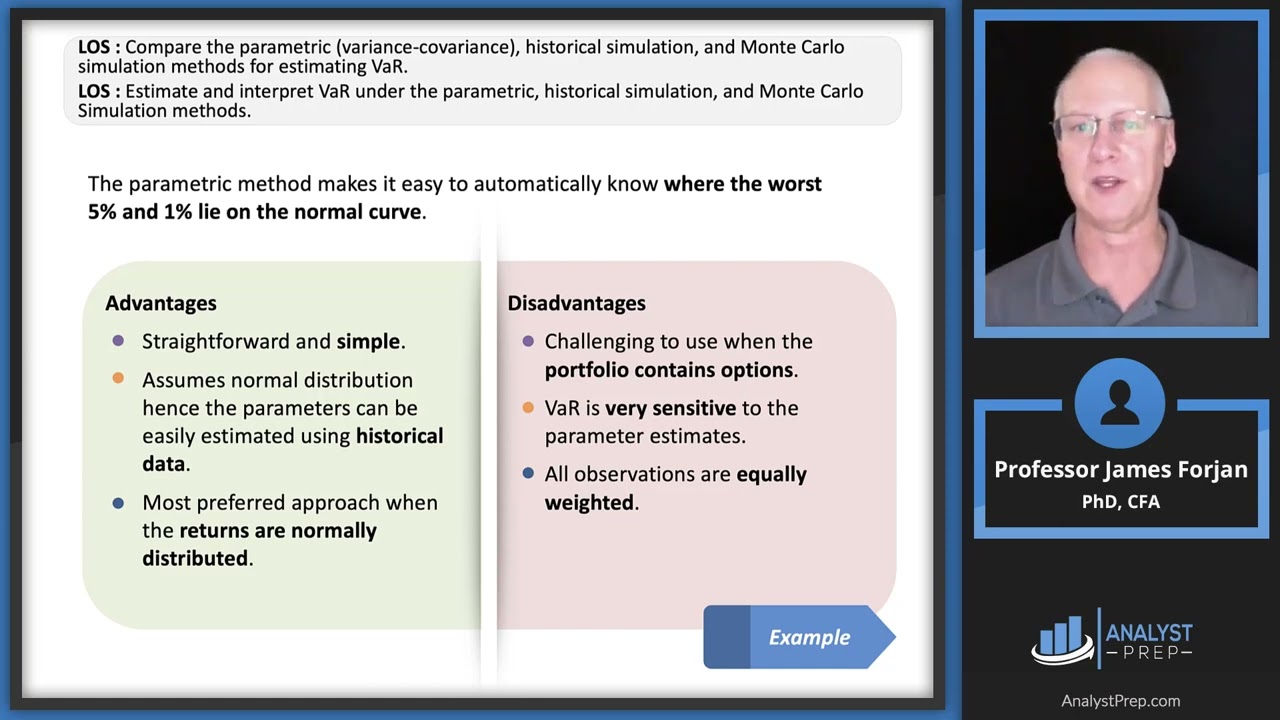

Crisis alpha is the amount of excess return generated in a down market event. 3 reasonably attractive investment returns may be achieved by passive long-only highly diversified. The theoretical expected return is calculated using CAPM and beta.

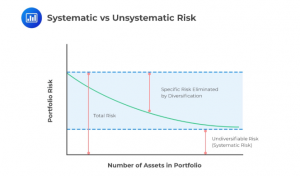

Trade-off is linear risk is best measured by equity beta and excess returns are measured by alpha the average deviation of a po rtfolios return from the capital asset pricing model CAPM benchmark. With these data alpha for the PCS total score is 96 but this may be a misleading reliability estimate because of multidimensionality. Which of the following best describes the effect of an increase in income on the demand for an inferior good.

This information can be had in MPlus by requesting the PLOT3 output as part of your. Since the CAPM return is supposed to be risk-adjusted Jensens α is also risk-adjusted. CFA CFA Level 1 CFA Level 1 Question of the Week Portfolio Management.

Rho Factor score varianceFactor score variance Factor score standard error2. MEASURE ABSOLUTE RETURNS Absolute returns are the returns achieved over a certain time period. One can see from this formula that if you increase the number of items you increase Cronbachs alpha.

By using the M² measure it is possible to rank portfolios and also to determine which portfolios beat the market on a risk-adjusted basis. The difference between the return of the actively managed portfolio and the return of the passive portfolio. Alpha 15 - 3 12 x 12 - 3 15 -.

A factor model C. Robert Ruggirello CFA is the Managing Director of Brave Eagle Wealth Management a NY based fee-only Registered Investment Advisor. An analyst gathers the following information.

α N c v N 1 c. Cronbachs alpha for household infant care and personal care domains was highly satisfactory except for social and community domain that was slightly low Cronbachs alpha 0626. Sequential Easy First Hard First.

Jason Voss CFA. In a rights offering the exercise price relative to the market price is generally. Despite an explosion of cross-disciplinary interest in researching the gut microbiome there remains to be a gold-standard method for operationalizing gut microbiome alpha diversity.

Expected Cronbachs alpha H 1 087. Absolute returns do not consider the risk of the investment or the returns achieved by similar investments. Here N is equal to the number of items c is the average inter-item covariance among the items and v equals the average variance.

Jason Voss CFA tirelessly focuses on improving the ability of investors to better serve end clients. Two portfolios have the following characteristics. And expected dropout rate 10.

Sample size requirement for Cronbachs alpha was calculated by the following defaults. The authors discuss and measure crisis alpha or the return from trend-following strategies when equity markets have a significant downside move. The human gut microbiome has emerged as a potential key factor involved in the manifestation of physical and mental health.

α p R p - R f βR m - R f. There are 20 questions in this test from the Portfolio Management section of the CFA Level 1 syllabus. Given researchers interest in examining the relationships.

The demand curve shifts to the left. Alpha is best measured by which of the following. CFA IF FE Answersdocx.

A portfolio that matches the return of the market will have an M² value equal to zero while a portfolio that outperforms will have a positive value. 21 Holding-Period Returns The performance of a security such as an equity stock or debt bond security over. The SDM-Q-9 presented reliability and validity according to the following indicators.

Security Expected Annual Return Expected Standard Deviation Correlation between Security and the Market Security 1 11 25 06 Security 2 11 20 07 Security 3 14 20 08 Market 10 15 10 Which security has the highest beta measure. Significance level α 005.

2022 Cfa Level I Exam Cfa Study Preparation

Sharpe Ratio Treynor Ratio And Jensen S Alpha Calculations For Cfa And Frm Exams Youtube

Portable Alpha Strategies Institutional Blackrock

Sharpe Ratio Treynor Ratio And Jensen S Alpha Calculations For Cfa And Frm Exams Analystprep

Chasing Warren Buffett S Alpha Cfa Institute Enterprising Investor

Sharpe Ratio Treynor Ratio And Jensen S Alpha Calculations For Cfa And Frm Exams Analystprep

Exposure Measures And Their Use Cfa Frm And Actuarial Exams Study Notes

Portable Alpha Strategies Institutional Blackrock

:max_bytes(150000):strip_icc()/dotdash_Final_Okuns_Law_Economic_Growth_and_Unemployment_Oct_2020-01-2e5dd7aa7c194e14a82707b84b00d1a3.jpg)

Okun S Law Economic Growth And Unemployment

How To Use Jensen S Alpha To Measure True Investor Performance

How To Use Jensen S Alpha To Measure True Investor Performance

Confidence Interval Example Question Cfa Level 1 Analystprep

Sharpe Ratio Treynor Ratio And Jensen S Alpha Calculations For Cfa And Frm Exams Analystprep

Alpha Formula Calculator Examples With Excel Template

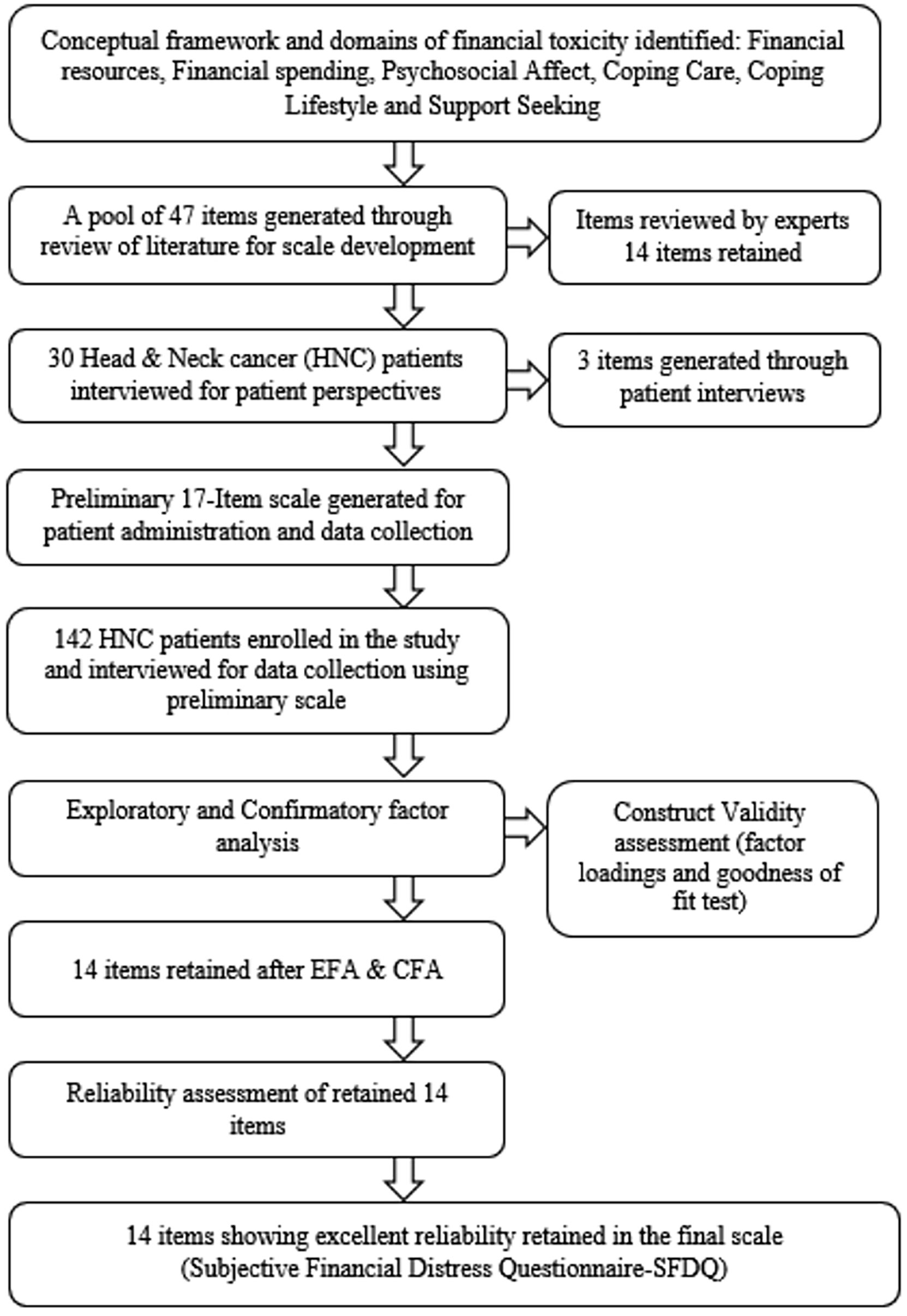

Frontiers Development And Validation Of Subjective Financial Distress Questionnaire Sfdq A Patient Reported Outcome Measure For Assessment Of Financial Toxicity Among Radiation Oncology Patients Oncology

/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

Comments

Post a Comment